Chưa có sản phẩm trong giỏ hàng.

Bookkeeping

Double-Entry Accounting Definition

Content

Because the business has accumulated more assets, a debit to the asset account for the cost of the purchase ($250,000) will be made. To account for the credit purchase, a credit entry of $250,000 will be made to notes payable. The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount. The above examples show contra asset accounts, but there are also examples of contra liability accounts and contra expense accounts that operate in the same way. The value in the contra account reduces the company’s actual liability from the stated figure in “Bonds payable.” Even if you use accounting software, there could be errors recorded in your bookkeeping. Sometimes, automated bank feeds either miss transactions or duplicate them.

Why is double-entry?

Double entry accounting reduces errors and boosts the chance of your books balancing. Companies massively benefit from using Double entry bookkeeping because, not only reducing errors, it helps with financial reporting and prevents fraud.

The key feature of this system is that the debits and credits should always match for error-free transactions. Accounting SystemAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. They serve as a key tool for monitoring and tracking the company’s performance and ensuring the double entry accounting meaning smooth operation of the firm. The first case denotes a debit record and a corresponding credit, indicating a net effect, which comes to zero. Although three accounts were given effect in the second case, the net entry between debit and credit is 0. Hence, the double-entry system of accounting suggests that every debit should have a corresponding credit.

Double-Entry Bookkeeping Examples

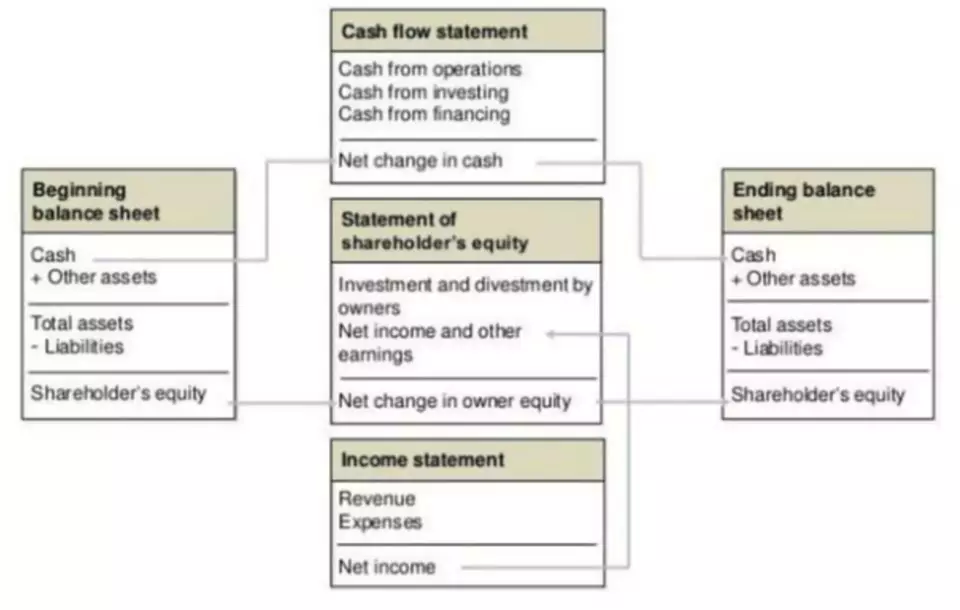

Free AccessFinancial Metrics ProKnow for certain you are using the right metrics in the right way. Learn the best ways to calculate, report, and explain NPV, ROI, IRR, Working Capital, Gross Margin, EPS, and 150+ more cash flow metrics and business ratios. All legitimate business benefits belong in your business case or cost/benefit study. Find here the proven principles and process for valuing the full range of business benefits. Example transactions illustrating the nature of double-entry accounting. In single-entry accounting, a single financial event calls for just one account entry. This accounting system sets the recordkeeping standards for all financial firms and industries.

What is difference between single entry and double-entry?

A single Entry System is a bookkeeping system in which only one part of a transaction is recorded, such as debit or credit. A double entry system is a method of recording transactions in which both sides of a transaction are recorded. This sort of bookkeeping is not for tax purposes.

We bet you have thought about getting all of these operations in place for your business. When a company pays a six-month insurance premium, the company’s asset Cash is decreased and its asset Prepaid Insurance is increased.

Who invented double-entry accounting?

Double entry accounting definition would refer to all the transactions that include two accounts being opened. Also where yearly business insurance is paid the Cash asset in the business will decrease as the Business insurance asset increases. It’s also the case with employee salaries where the business’s Salary Expense will go up and the Salary Payable liability account increases. Also once workers’ salaries have been released, both the Salary Payable account and the Cash account will decrease.

How a General Ledger Works with Double-Entry Accounting Along With Examples – Investopedia

How a General Ledger Works with Double-Entry Accounting Along With Examples.

Posted: Sun, 26 Mar 2017 06:32:23 GMT [source]

A bakery purchases a fleet of refrigerated delivery trucks on credit; the total credit purchase was $250,000. The new set of trucks will be used in business operations and will not be sold for at least 10 years—their estimated useful life. Furniture costing $2,500 is purchased on credit from Fine Furniture.

Contra Accounts Reverse the Debit / Credit Rules

Rather, it relates to the two-sided nature of every transaction. For every transaction there is an increase in one side of an account and an equal decrease in the other. Liabilities in the balance sheet and income in the profit and loss account are both credits. So, if you buy something on credit, the amount is credited to the supplier’s account. Nowadays, the double-entry system of accounting is used all over the world. This is because it is the only reliable system for recording business transactions. The system of bookkeeping under which both changes in a transaction are recorded together at an equal amount (one known as “credit” and the other as “debit”) is known as the double-entry system.

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

The double-entry system also requires that for all transactions, the amounts entered as debits must be equal to the amounts entered as credits. Since the asset account decreased and increased by the same amount, the overall accounting equation didn’t change in this case. The total debits and credits in an accounting system must always be equal just like the equation itself.

Arithmetical accuracy of accounting can be verified through the preparation of trial balance if the accounts are maintained under the double-entry system. This transaction https://www.bookstime.com/ involves two accounts – a furniture account and a cash account. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

Tivi – Màn hình

Tivi – Màn hình Tủ lạnh

Tủ lạnh Tủ đông – Tủ mát

Tủ đông – Tủ mát Máy giặt, máy sấy

Máy giặt, máy sấy Loa kéo – Loa bộ – Loa máy tính

Loa kéo – Loa bộ – Loa máy tính Dàn karaoke , micro

Dàn karaoke , micro Máy lọc nước, Máy hút mùi, hút bụi

Máy lọc nước, Máy hút mùi, hút bụi Đồ gia dụng

Đồ gia dụng Nồi cơm, Nồi lẩu, Nồi Chiên

Nồi cơm, Nồi lẩu, Nồi Chiên Camera Giám sát,Camera wifi 360

Camera Giám sát,Camera wifi 360 Thiết bị mạng internet,Wifi

Thiết bị mạng internet,Wifi Giới thiệu

Giới thiệu Khuyến mại

Khuyến mại Giao hàng nhanh 24h

Giao hàng nhanh 24h 7 ngày đổi trả

7 ngày đổi trả